how to pay late excise tax online

THIS FEE IS NON-REFUNDABLE. Our Tax Experts Are Available To Be Your Dedicated Advocate To Save You The Most.

Pay Your Taxes Online Canada Ca

The tax collector must have received the payment.

. Edit Fill eSign PDF Documents Online. Based On Circumstances You May Already Qualify For Tax Relief. If your excise tax payment is late you must pay additional penalties and interest based on the amount of taxes you owe.

Distributors and noncommercial importers of beer and liquor for sale or use within New York City must pay this tax. If your excise tax payment is late you must pay additional penalties and interest based on the. Ad See If You Qualify For IRS Fresh Start Program.

If you file Form 5330 on paper make your check or money order payable to the United States Treasury for the full amount due. Fast Easy Secure. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Online Payment Search Form. Attach the payment to your return. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

See reviews photos directions phone numbers and more for Pay Excise Tax locations in Piscataway NJ. What happens if you pay your excise tax late. Penalty and deadline to.

A motor vehicle excise is due 30 days from the day its issued. TTB Excise Tax Returns and payments must be mailed to. See reviews photos directions phone numbers and more for Pay Excise Taxes locations in Piscataway NJ.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue date. However if you purchase a.

Ad Register and subscribe 30 day free trial to work on your state specific tax forms online. Please fill in both and hit login button to enter online section of website Email Address. Massachusetts Property and Excise Taxes.

WE DO NOT ACCEPT. For your convenience payment can be made online through their website. Ad Real Tax Solutions For Real People.

Please note all online payments will have a 45 processing fee added to your total due. Dont File Duplicate Excise Tax Forms Paper excise forms are taking longer to process. Late returns or payment are subject to penalties and interest.

New York State Beer and Liquor Excise Tax. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. ATL - Lates Tax Financial News Updates.

For Vehicles on the road. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. After receiving your bill you should fill out the.

Not just mailed postmarked on or before the due date. Convenience fees for paying excise taxes online. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor.

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. If your excise tax return is late you must pay a penalty based on the amount of taxes you owe. This includes Forms 720 2290 8849 and faxed requests for expedite copies of Form 2290.

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. If you dont make your payment within 30 days of the date the City issued the excise. The service fees for pay-by phone are the same as indicated above for paying online.

Payment at this point must be made through our Deputy. Tax on Property vehicles. Free Case Review Begin Online.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. If you wish to use the pay-by-phone service please call toll-free. Ad Apply For Tax Forgiveness and get help through the process.

Internet Sales Tax Definition Types And Examples Article

Changes In Income Tax Return Forms For The A Y 2015 16 Read Full Info Http Www Accounts4tutorials Com 2015 08 Key C Income Tax Return Income Tax Tax Return

Internet Sales Tax Definition Types And Examples Article

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Tax Filing Taxes

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

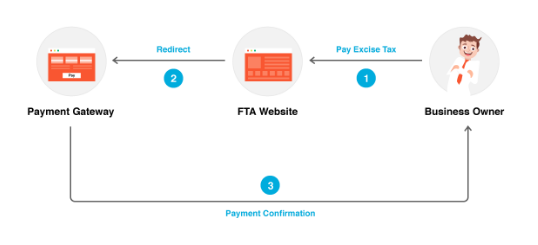

Excise Tax Return Filing And Payment Zoho Books

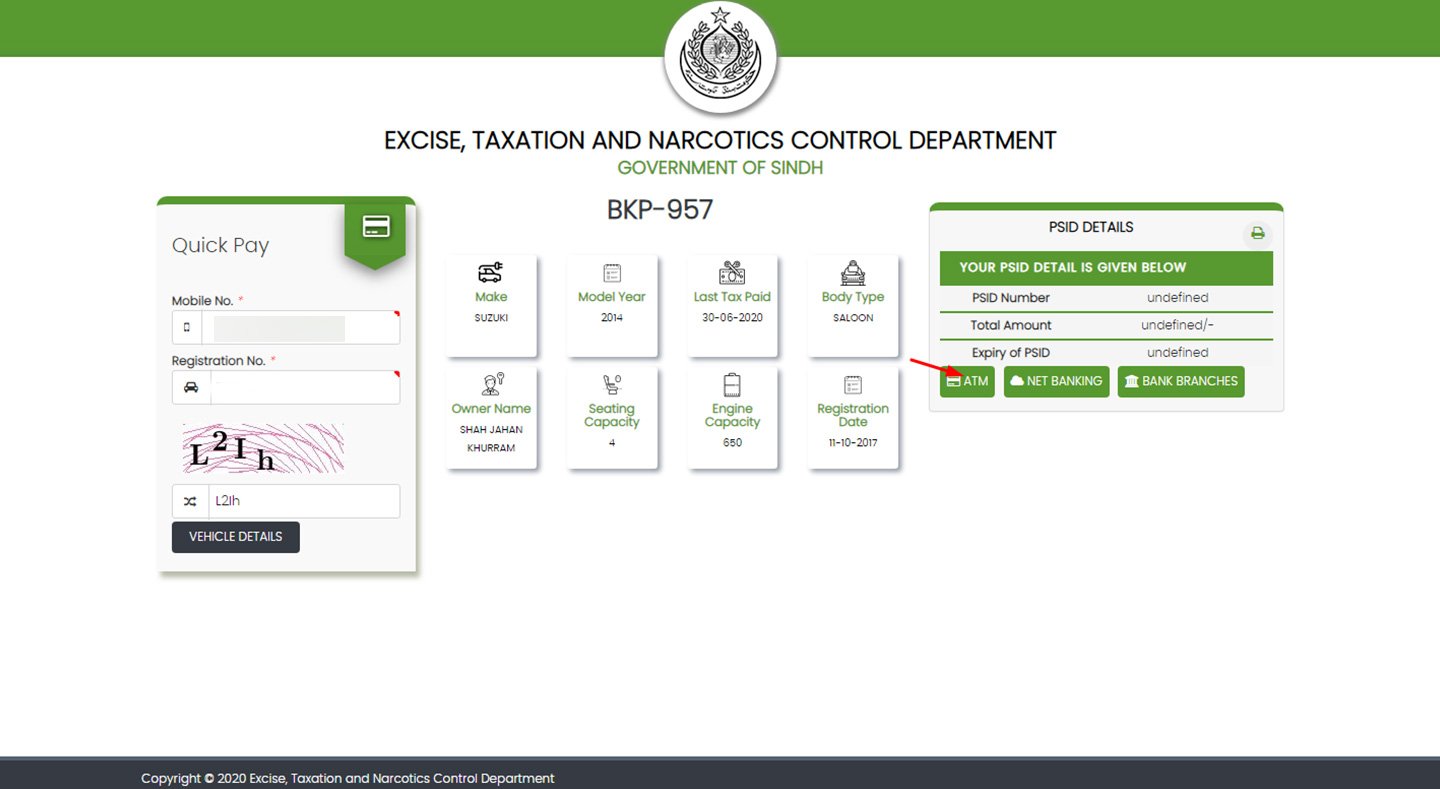

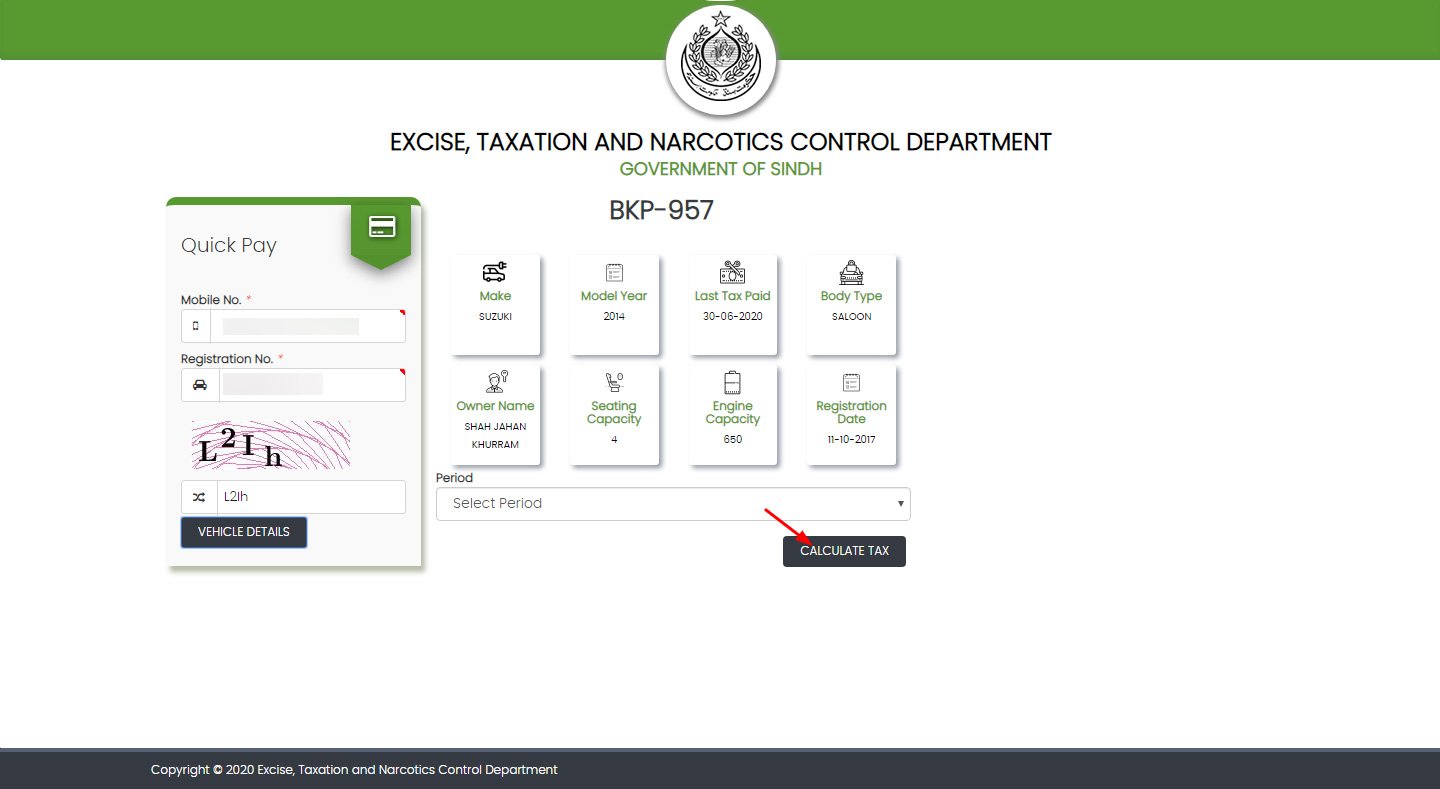

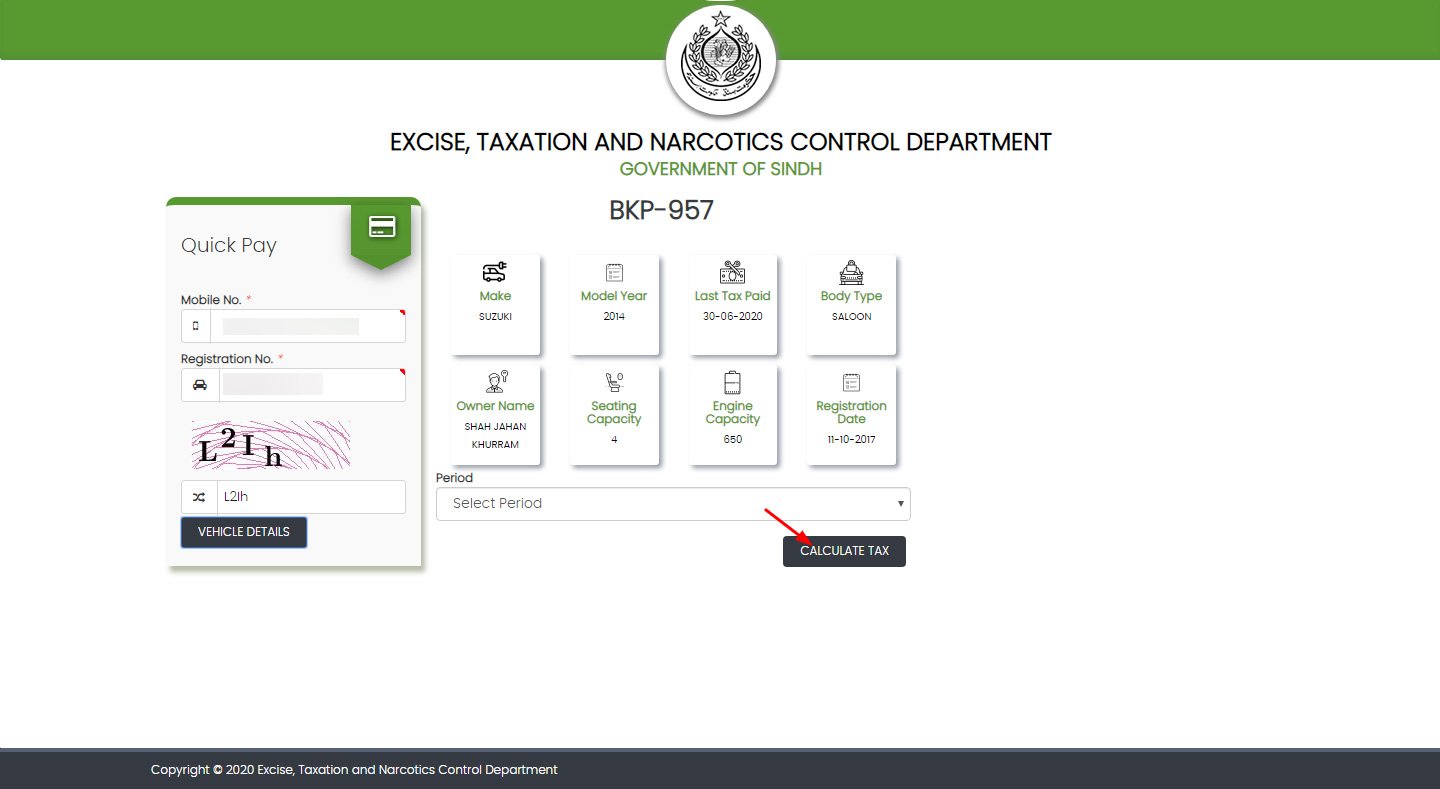

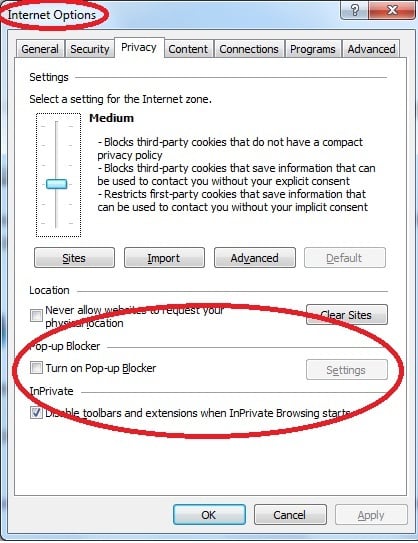

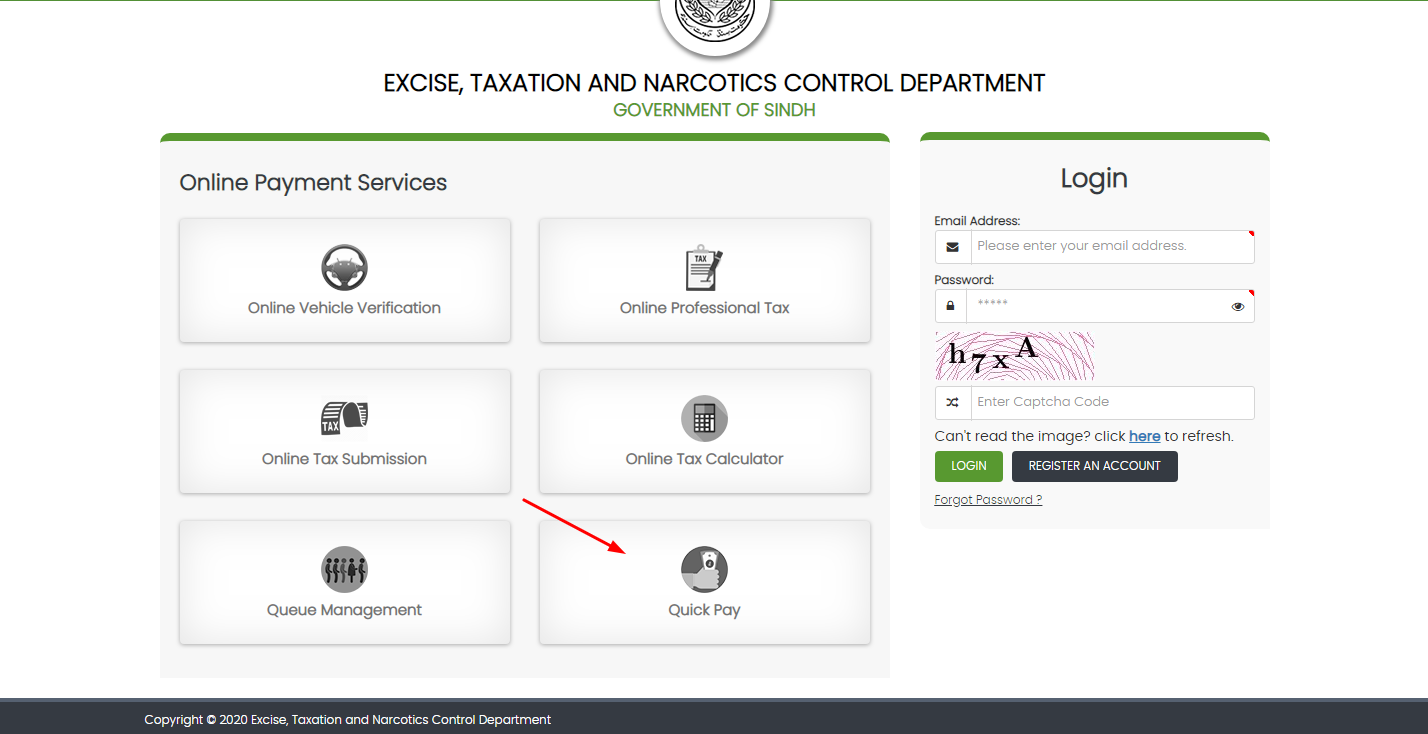

How To Pay Your Vehicle Tax Online In Sindh Zameen Blog

How To Pay Online Motor Vehicle Tax Token Tax In Sindh

Online Bill Payments City Of Revere Massachusetts

Online Bill Payment Town Of Dartmouth Ma

Today August31st 2018 Is The Duedate To Efile Heavy Vehicle Use Tax Hvut Form2290 For Taxyear 2018 2019 Any Taxreturn Submi Tax Return Due Date Irs

Pay Your Taxes Online And On Time Canada Ca

How To Pay Business Taxes In Canada

Online Tax Payment Fbr Adc Tax Payment Online Internet Banking Atm Mobile Banking 2021 Youtube

Tax2290 Com Taxexcise Com Is A Proud Member Of Tennessee Trucking Association No Need To Manually Fill In Tax Forms Doing Compl Irs Truck Driver Trucks

How To Pay Online Motor Vehicle Tax Token Tax In Sindh

Pin By Chris G On Vintage Electronics Vintage Electronics Low Tech Design